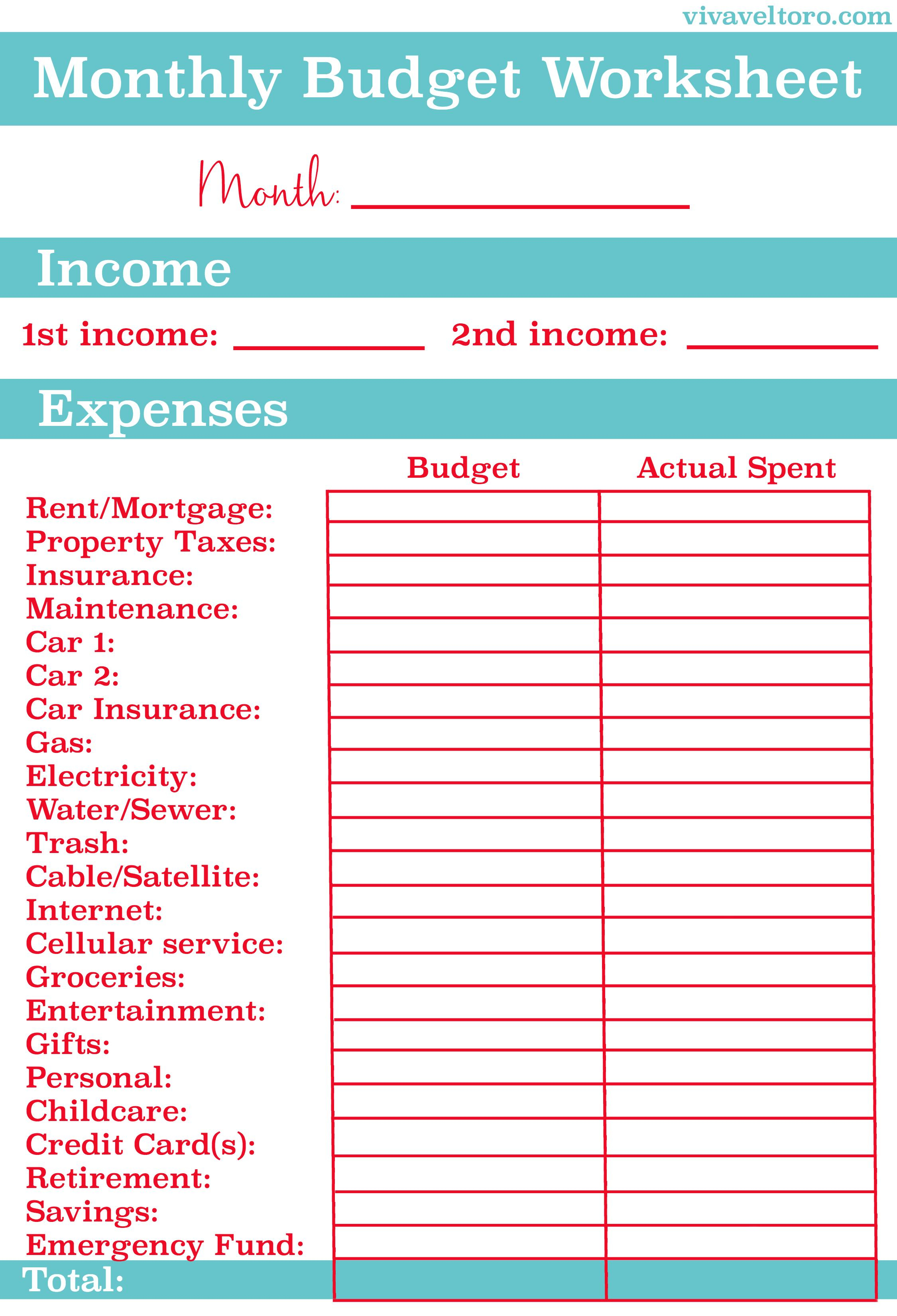

The purpose of this process is to understand where your money is going so you can pinpoint problem areas, get feedback from others (if you need help from the community, make a post!), and identify opportunities to reduce spending if needed. You can try to estimate the monthly average cost for non-monthly expenses so they can be included in your monthly budget or you can put them into a separate section of your budget.

#Free simple personal budget software how to#

Try to follow the steps in the Prime Directive article for guidance on how to allocate extra money. It includes paying off debts, saving for future goals, and saving for retirement. Saving and Debt Repayment: This is the portion of your budget that goes to "future you". Try to be specific with each item using categories that aren't overly broad such as: This is your discretionary spending on non-essential expenses such as dining out, entertainment, hobbies, and shopping. Wants: After documenting your needs, look at your "wants". Health care costs, health insurance, etc.Electric, natural gas, water, and any other utilities.This includes any kind of mandatory spending, anything related to safety and survival and includes: Needs: Once you have after-tax pay, list out each of your "needs" and how much each one costs. In months where you have extra money left over, that can be used to increase your savings or pay down debts. If your monthly income fluctuates, try to base your budget on a worst-case or lower-than-average scenario.This will help you budget out the worst-case scenario.

If you're paid twice per month, you might want to grab your February pay stubs (or a calculator) and see what 10 workdays of pay looks like, then multiply by two.If you're starting a new job and planning ahead, use an after-tax paycheck calculator to get some rough numbers. Income: Start with listing your monthly income, either four weeks or 30 days of after-tax pay. Having a budget will help you allocate your money more effectively and make it easier to reach your financial goals. You should focus on tracking all of your expenses for the month, using a method of your choice listed below in the Tools/Systems section.

Here, please treat others with respect, stay on-topic, and avoid self-promotion.Īlways do your own research before acting on any information or advice that you read on Reddit.īudgeting is the foundation of your financial house. Get your financial house in order, learn how to better manage your money, and invest for your future. Banking Megathread: FDIC, NCUA, and your cash.Private communication is not safe on Reddit. Scam alert: Ignore any private messages or chat requests.

0 kommentar(er)

0 kommentar(er)